XLOptics is the story of a very successful startup company in Silicon Valley. The VCs took over the company, brought their own CEO, fired the original founders, then bankrupted it without showing any financial reports, then had their CEO (the CEO imposed by the VCs) assign all of the patents and products to the VC for $25 K, while their CEO took $120 K home in severance pay, then they said: The company did NOT have any product! Here is how they stole the company from me:

Rahim Amidi (Co owner of Plug and Play Tech Center and Amidzad) came by XLOptics (my company) with Alex Hern who talked to my co founders and top VPs for 8 hours & said with a sympathetic voice: “Why are you guys working so hard when Dr. Imani (me) owns most of the stocks of the company?” Meanwhile Amidi humiliated me in front of everybody: “Dr. Imani you are sacrificing the future of the company along with the interest of the preferred share holders for your own ambitions by remaining as CEO. We have a much more qualified person (a product line manager from Broadcom!) than yourself to run the company”. Amidi’s CEO was supposed to bring $10 MM and accounts, 75% market share, from #Broadcom to #XLOptics. History proved that both Alex Hern and Amidi were liars with just empty promises. Amidi’s CEO bankrupted the company without showing a single financial statement, assigned ALL of the products, IPs of the company to Alex Hern for $25,000. Then Amidi said: “XLOptics was a bad investment and should not have been funded at all”. He mistook XLO for a carpet shop. XLO’s competition went public!. Please read part 7 of XLOptics story about my discussions with Steve Jobs.

XLOptics shows a different side of Silicon Valley, and how it really works.

XLOptics story is very instructive for people outside of Silicon Valley.

Here were the players:

Alexander F Hern

Jeff Saper

Peter

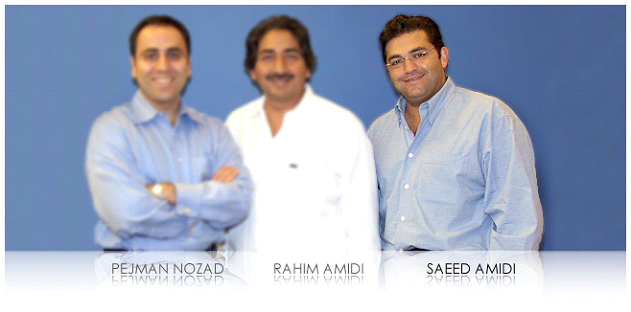

Rahim Amidi and Pejman Nozad

Part 1:

This is the story of @XLOptics (@XLO) a very successful startup company that the VCs took over with the help from the law firm of @WilsonSonsini (www.WSGR.com) that was supposed to represent the company. VCs brought their own CEO, fired the original founders. While out of the company, both Behzad Razavi (#1 circuit designer in the world) and I tried to bring new investors to XLO. The reason was obvious. Both Behzad and I were the majority share holders of the company. When @AlexHern the VC couldn’t handle, manage and run the company, they drove XLO to bankruptcy. Their CEO assigned ALL of the company Intellectual Properties (IPs), product samples, designs, etc … to the VC who assumed all of them (all of patents, product samples, and designs) for $25,000. @AlexHern (Major Investor), @RahimAmidi and @SaeedAmidi of @Amidzad Ventures (Minor Investors) needed someone to blame for their shortcomings and failure of @XLOptics. So they blamed me, the founding CEO, for their own failures. They stained my reputation, and discredited me among the Hi Tech community, entrepreneurs, Stanford community and VCs in Silicon Valley. I suffered a heart attack when transferring power from myself to their puppet CEO during the transition time, and after I learned that the offer letter I had signed and hired the new CEO with, did have the $10 MM investment clause in it but someone had added the word “option of” in front of it. In other words, we were deceived by Alexander F. Hern and Amidi who had promised us that the new CEO would bring $10 MM with him to the company. Mostafa Ronaghi witnessed my heart attack. The scars of the heart attack still exist on my heart tissues. I had raised $9 MM for XLO, but had spent about $2 MM of it, when the new CEO took over. I never saw a financial statement by XLO afterwards, so I never learned what happened to the rest of the money. Rahim Amidi, Saeed Amidi and @PejmanNozad were building up their reputation at the expense of destroying mine while recalling their XLO experience in parties and meetings. They never took responsibility for imposing their own CEO on XLO. I can prove it all.

The bankruptcy of XLO was a great news for @Infinera, and @InPhi that went public 7 and 10 years later, with $3.5 Billion and $1.2 Billion exits, respectively.

After the VCs drove the company to bankruptcy, I was left alone to deal with the creditors of XLOptics for 3 years. Then the president of AT&T told me that OC768 had a great Market potential, referring to XLO’s product line. Mostafa Ronaghi witnessed that conversation. So as I was getting ready to revamp the company and become a second Steve Jobs, someone reported me to FBI. The allegation was that Behzad Imani was to transfer and sell the products of XLO to Iranians who were under sanctions. Later Alex said and confirmed that Amidi’s designated CEO of XLO, repeatedly wrote to Alex that Behzad was selling the company products and IPs to others. My co-founders and I dealt with FBI for 3 1/2 years while being under exhaustive investigations. I stood by my troops and Behzad Razavi during those difficult years when we were being investigated. After FBI gave us a clean bill of health, IRS entered into the scene because the VC along with their puppet CFO had filed for some Mickey Mouse tax returns. They had changed the name of the company from XLOptics to Transpectrum, but filed for company tax returns under XLOptics, Inc! They never had informed the Government, nor the State of Delaware, that @BehzadImani was no longer the CEO of XLOptics while they were looting the company. So the liabilities of XLO did remain with me. IRS next moved to audit my personal tax returns. I was busy with IRS for a good 2 years. Then when I thought the nightmare was over, another issue came up. The company had mismanaged the 401K plans of my coworkers, employees of XLO. I had to deal with it, clean the issues up for another 1 1/2 to 2 years.

During times, most VCs turned me down. Let me give you an example: Long before Uber come into the scene I led a team of software engineers who implemented the backbone of Uber software (2004-2007), and then filed for a patent on it for “brokering the service business” in September 2007 just a few months after Steve Jobs introduced Apple iPhone. My patent title was: Broker Service Provision (USPTO Application # 11899728 filed: Sept 07, 2007). The patent office never granted me the patent. The excuse was that I had submitted color pictures to illustrate the patent mechanisms. All I had to do was to resubmit the patent with black and white images. But I was so busy with FBI and IRS that I never had the chance to respond to USPTO. I did contact the USPTO, Patent office. The person who answered my call said that the Patent Office never grants patents to ‘a way of doing business, especially a service business’. Moreover, the VCs told me that VCs would not invest in ‘service business’. But two events ensued: Someone by the name of Hamid Reza came to my house in Aug 2008. I told him that I was super busy with IRS and that a financial melt-down was around the corner; But also told him about how our software that was brokering the service business, such as Taxi business, worked. Our starting target niche market was Airport Shuttle business to and from Airports in the top 50 metropolitan areas. I told Hamid Reza to take it over and raise “the go to market” money for it. I was super busy with IRS. In 2016, I learned that Hamid Reza turned out to be a guest (or temporary roommate) of Shervin Pishevar during those decisive months of 2008. Shervin Pishevar, a VC, went on an invested the seed money in Uber in 2009 and then brought along other VCs (Bench Mark Venture Capital) to Uber. The rest is history. I could neither raise money for my surface plasmon, nor for my energy optimization patents, that should be the crown jewel of Iranian community for years to come.

I can prove all of the above.

In Summer of 2009, I ran into Saeed Amidi and Kayvan Baroumand at an Stanford event. My “brokering the service business software” was ready to go. I told Saeed about it. But Saeed Amidi turned me down saying: “We were NOT happy with XLOptics”! To every VC firm I went, my reputation preceded me, as someone who had raised, and then consumed $10 MM without delivering a product. One day in 2010, Mostafa Ronaghi told me to leave Silicon Valley because there was no way for me to raise capital anymore. He compared my situation to someone he knew in Europe. Yet some other day later (Aug 2010), I met with Hossein Nikoo, cousin of Mostafa Ronaghi, my friend for 40 years. He asked me what I had done with $10 MM?! I was baffled. Yet, in 2013, my own cousin in Iran asked me what I had done with $10 MM and why I had ripped off $10 MM from the VCs. After a F-50 conference in San Francisco, someone asked me what I had done with $10 MM as if I had stolen $10 MM money from the VCs. I even heard rumors about me as far away as in Canada. I was speechless. Because, out of the $9 MM I had raised for XLO, I had spent less than $2 MM when Amidi’s CEO took over. I never learned what had happened to the rest of the money ($9 MM – $2 MM).

Meanwhile, Amidi went on and told Stanford students, whom I had supported and brought to Stanford from Iran, that Amidis (Saeed Amidi and Rahim Amidi) would not get in ANY DEAL that @Imani was involved in. This writing is my first step to set the record straight.

XLOptics Pre Money Negotiations:

I started XLOptics, as a design and manufacturer of optical components for the Communication and Telecom Industry. Our sector, the Telecom sector, was HOT, very HOT, very very HOT. To illustrate the point: Almost every week I received a telephone call from various VCs trying to pitch themselves to me, asking me to raise money from their VC fund. I never ever called a VC, solicited funds from or pitched XLO in front of any VC. I swear to God, I never called a VC not even once. It was the other way around. The VCs reached out to me all the time. Most VCs threw lavish parties (say in the top floor of the SF Fairmont Hotel, or in their VC firms, or in some Club house), or invited me over to breakfast, lunch or dinner begging me to raise money through them. A lady VC once told me what could she do to have my Sinatra eyes look at her term sheet? (I thanked her for her complements). Another lady VC once told me that every time she met me, she saw a $100 Million profit walk by her eyes. Kamran Elahian told me: “I like your name (Imani means faithful) but I love your company name even more because it had Optics in it”. Another VC told me that her company did anything, ANYTHING the CEO wanted, for their CEOs!

Let me paint a picture of the startup landscape in Telecom sector then:

Every Communication Startup with a $10 MM VC investment, either would have been bought off within a year or two by a public company, or would have gone public within three to four years. The underlying belief, as declared by Goldman Sachs, was that the bandwidth demand was doubling each year thus the need was persistent and pertinent for Telecom components, sub-systems and systems. Therefore the Telecom sector was HOT, Sizzling HOT. Cisco used to buy every startup Comm company out there, would hire new university graduates right off the school and used to give them a brand new convertible sport car as hiring bonus. The market was that HOT!

Let me give you another example. On my way to OFC show in Anaheim, I sold 10,000 components at $40 per component for a total of $400K to the lady sitting next to me on a Southwest 737 airplane heading for the John Wayne airport in Orange county. She insisted that I put a promissory note with my signature on the back of a napkin. I did so. I told her I would deliver the components within six months. The market was that HOT!

I was friends, close friends, with Mr. Amir Amidi Sr. who looked up to me with respect.

He used to take refuge on to me for he, like myself, was from Southern Tehran but had some stains, some dark moments, in his past that he was trying to escape from and put behind him. He once told me that he wanted his sons to be like me, educated, mild manner and in Hi Tech. One bright sunny day in June of 2000, Y2K, he ran into me as Mr. Falahati and we were walking down on the University Ave in Palo Alto during lunch time. He shook my right hand and then with his left hand grabbed my right hand wrist, then he asked me for two favors: 1) that I would help him build a Mosque for him in Palo Alto, 2) that I would help his sons Rahim Amidi and Saeed Amidi enter into the VC and startup business. I promised him that I ‘d oblige on both fronts for him. However, less than 3 weeks later, he passed away from a sudden heart attack. I was deeply saddened. But I kept and honored my promises to him.

A while later, Amir Amidi Jr approached me. Amir Jr. asked me to consider SVIC (Silicon Valley Internet Capital, www.svic.com) headed by Alexander F Hern (aka @AlexanderHern, aka Alex Hern) as an investor and Amidi brothers as the brokers. Recalling my promise to Mr. Amir Amidi Sr. I said: “why not?”. I turned down all other VC offers, term sheets, because I wanted to help out the Iranian community, bring them into Hi Tech, and wanted to help out Amidi brothers (Rahim Amidi and Saeed Amidi) in particular per my friendship with their father.

SVIC recommended and I hired @JeffSaper of WSGR as company attorney. As part of pre money negotiations, we agreed that SVIC deposit the money in #WSGR escrow account on Thursday, then I would send out and email asking my co-founders to resign on Friday, send the proof to SVIC and then WSGR would release the money to XLO’s company account by Friday at noon. Everything went on as planned and as agreed upon, but with one exception. WSGR DID NOT transfer the money to XLO’s account. I thought they were probably busy and so WSGR would transfer the money on the following Monday. They never did. WSGR betrayed me. Let me explain:

By Monday evening I was under about $2 Million worth of obligations. Suddenly Alexander F Hern, Amidi along with their lawyers came to XLO’s temporary Menlo Park office around 7 p.m. They accused me of having an extra marital affairs with a VC lady. I thought they were kidding me! So I laughed it up and tried to be silly about it: “I don’t blame ladies who fall in love with me, what’s not lovable about me?” I said with a smile. Secondly, I said : “I didn’t know priesthood and celibacy was part of our pre money negotiations and part of the funding requirement!”. I was fending off their aggressive comments. Finally I denied having any extra marital affair with any lady. Because I never did. I had my Bill Clinton moment: “I never had any relationship with that lady”, with one exception. Bill was dishonest, but I was honest about it. Yet SVIC told @WSGR not to release the money. I called WSGR attorney who avoided me. Finally SVIC handed me some papers to sign. I thought it was an extortion but I did sign them because I was under $2 Million of obligations. I had to meet the payroll for ALL my co-founders who had trusted me and had resigned from their jobs and had joined XLO. WSGR withheld the money for another week until March 16th, when I was supposed to meet a payroll.

Alex also hired a young fellow, an ex-analyst from Goldman Sacks, by the name of Peter Buckhardt (Peter@SVIC) who suffered from lack of hygiene. He always smelled. I had to sit two chairs away from him at all times. He was a living definition of a Nerd who asked me technical questions only to observe how I would react, instead of being interested in the answers to the questions. He was definitely incompetent, but tried to impress me with a serious inquisitive face. He never did.

An extra ordinary event happened on or about the week of March 16 or in the following week. John Chambers, CEO of CISCO and the 800 lbs Guerrilla of our market, gathered most influential New York and Silicon Valley analysts and told them CISCO was halting on all purchase orders for three years (I am paraphrasing). As is the case with such important news, the info was kept away from us in the main street and circulated only among the top stock movers of the Wall Street for some time before “we the people” learned about it. The top VC firms in Silicon Valley were obviously in the loop with the Hi Tech analysts, because out a sudden, I stopped receiving calls by the VCs who up until two months before, used to call me every week and were upset that I had signed a term sheet with a small SVIC $130 M VC fund!

Following John Chambers meeting with analysts, The Communication sector in NASDAQ started collapsing at the rate of about 2% to 5% per week after institutional investors started dumping their Telecom and Comm Stocks.

The attitude and behavior of @AlexanderHern suddenly changed. He suffered from buyers remorse. He felt he had paid too much money for XLO’s stocks. He had an indecent proposal for me that I could not accept. So he started talking about replacing me by bringing his own Yes-Sir CEO, someone who would bend over for him.

Before I describe his indecent proposal to me, let me tell you another story. Alex said that @VinodKhosla (then of @KPCB) used to invite the CEO of his portfolio companies to his ocean side ranch, cook them some BBQ, and would tell them: “You can have a life style like mine (like Vinod’s) and be my partner, if you just listen to me and do as I say”. To this date, I couldn’t verify Alex’s claim and if what Alex was saying about Vinod Khosla was true or false. I believe Alex made up the story to justify his proposals to me. Alex didn’t want a real CEO like myself. He needed and looked for someone who would become his accomplice.

In several occasions, Alex told me that he needed to assume the entire option pool (About 40% of XLO stocks that I had set aside for the CMOS team of Dr. Behzad Razavi and Dr. Ali Hajimiri) because the market valuations for startups were plummeting.

Moreover Alex, who had no formal education and had come from a very broken family, used to insist that @Wilsonsonsini (WSGR) was on his side and that if I joined forces with him and screwed up my co-founders for the benefit of him and his VC firm, he would protect me. He always said that founders and co-founders were financially deprived and could not fight him and bring an expensive law suit against him in a court of law. He always bragged about making $600 MM within a year. But I always thought of him as a “Hype master”. He was a perfect pitch man or salesman for the Dot Com (Dot Gone) era for companies that had no revenue. He could sell a chicken instead of a turkey, if you know what I mean.

Alex was a small part of Inktomi when it went public. Then he had started YesMail and had sold it for $600 MM within a year at the height of the Dot Com (or better say Dot Gone) era.

I told Alex that in Silicon Valley it would take an average of 7 years for a company to experience a successful exit. But he insisted that he could beat the odds and could turn around a company, any company that he focused on, and sell it within a year or two.

I was happy and loved to see the upcoming recession then. Because I believed that the market challenges during a recession would separate the men from the boys.

As for myself, I had finished high school at the age of 14, and earned my Ph.D. when I was 23 years old. Then I had started my own self incubator (Silicon Valley did not have accelerators or incubators then). With $12,000 I had started a glass company that I later grew to about 800 full time and part time employees. We used to serve customers in all 48 States. I used the profits from my glass company to incubate and finance my own R&D, and several startups including XLOptics

I was a soccer player, playing the forward position and scored beautiful goals. But I never ever celebrated after scoring goals because I always felt that I was doing my job, my duty, and what my team had trusted me with, and expected me, to do. Sometime in a game, even if we were 3 goals behind, I never lost my self confidence because I knew, I had faith in myself, that we could come back from a 0-3 deficit and win the game.

I knew one thing: I was born a leader and would die as a leader. I was/and still am full of self confidence… For example, I just ran for the president of Iran! I also took on the entire Democrat party establishment in 2016, and involuntarily exposed HER email scandals to FBI.

Not shying away from challenges, is a character of people of Southern Tehran where I come from. I walk, think, talk, and command with confidence.

Part 2:

My BIGGEST MISTAKE was that I trusted Wilson Sonsini (WSGR) as a neutral firm representing the company. No they were not neutral at all! They were always on the side of, if not in bed with, the VCs.

I had set aside about 40% of XLOptics stocks for Professor Ali Hajimiri, Professor Behzad Razavi, and CMOS team at the close of Series-A. I was planning on signing them up after the Optics team Formed, Normed and Performed.

But Why did Alexander F Hern wanted to replace me and bring their own “Yes-Sir” CEO who would bend over for the VCs? Here is the answer that implicitly shows the duplicity of #WSGR. It serves as an example of @WilsonSonsini (Wilson Sonsini Goodrich & Rosati) giving WRONG advice to the company and covering up for the tracks of the #VCs. Alex wanted the entire option pool (the entire 40%) for himself because he said “the valuations for Comm stocks had plummeted”! Moreover, Alex thought he could run the company from Board of Directors level.

Alex had a peculiar mentality and a huge ego. He did want XLO become successful under one condition: He wanted XLO’s success on his terms and conditions, and ONLY on his terms and conditions. He would otherwise write off his ~ $9 MM investment in XLO as if $9 MM did not matter to him at all. Looking back at several of our conversations between Alex and myself, I could conclude that Alex had an obsession with XLO. He wanted XLO, the entire XLO for himself or else he would have rather seen XLO go down to bankruptcy. In that sense, Alex’s view was very binary. I had observed “Obsessive” behavior in the movie Fatal Attraction (Michael Douglas, Glenn Close, and Anne Archer, the film centers on …some couple during troubled times). Alex wanted to see XLO alive only if XLO was his, but he wanted to see XLO dead if XLO was not completely his.

XLOptics was my baby. I loved it. And XLO’s success was what mattered to me. This is the case with most of startup founders in Silicon Valley. They look for success not money. But to Alex, XLO was all about money, just another deal from where he wanted to maximize his profits, another company that he would bankrupt if XLO did not follow him, or his guidance, or his management from the BOD level, and or his ego. This was when he couldn’t wake up any sooner than 11 a.m. in the morning, and he did not have any, I mean any, knowledge of the Telcom market directions, management, players, competition, etc. In other words he had a binary approach towards XLO that was: XLO would win if he won, XLO failed if he failed under his management from BOD. He thought of himself as the center of the universe. What surprised me was when he said to me: “He did NOT want to see XLOptics’s success if XLO had to deviate from his management guidance or if he had to listen to me (Dr. Imani)”. I was at the top of XLOptics’ Technology and Market with a great vision for XLO then. I prompted his reaction after I said to him: “Let me (Imani) be in the driver seat, you (Alex) sit in the back seat, relax and enjoy the ride to success”. Alex refused because he wanted to be the only Major VC in, and gobble up the company and invite his friends to be share holders of the company on or shortly before exit. He would become upset if I told him I wanted to bring in other VCs to XLO. Alex had planned on being XLO’s only major investor in the first couple of rounds of XLO financing until he owned the majority of XLO stocks. He had an obsession with himself too, and an ego as large as a Black Hole, that I had only seen in the movies. He always mentioned that he had made $600 MM within a year by selling Yes Mail at the top of the Dot Gone ear. He used to forget telling others that he made the $600 MM with a Hype, not by generating justifiable revenue for Yes Mail during the Dot Com (Dot Gone) era.

I was trying to be as accommodating as possible to his demands, to his behavior, and to his ego. During the process, I developed an empty for him. Alex and people like him would always remain lonely. They can never develop nor maintain long term relationships, marriages, etc… I also noticed that he had developed a Bi-Polar character. He would tell me something in private, then took a 180 degree opposite position in front of others or public. I thought his Bi-Polar charter stemmed from the tough childhood that he had suffered from. In addition to above, Alex had another character deformation. Alex was anxiously unfocused. He had been sued by a Greek CEO of a previous startup he had funded. And Alex had to cough up $2 MM to settle that case. I could never trust a word he said. Because most often, he changed his views, arguments, logic, reasoning on the fly trying to change outcomes of arguments, as he saw them fit, to his advantage. But one thing was crystal clear: Alex worshiped himself more than he worshiped money (stocks of XLO), and vice versa, depending on the time of day and whom he was talking to.

Alex’s Indecent Proposal: About 4 months after Series A closing, Alexander F Hern on behalf of the Major VC (Major Preferred Stock holders) approached me & asked me to give them MORE stocks (more than what the company had given to the VCs for their Series A investment). Furthermore he claimed the Option Pool was his with NO MORE MONEY committed by the VCs or any further investment by him. Alex had mentioned his demand to me together with Mr. Nader in some other occasions too. Alex’s reasoning was that “the market valuation” for our sector had gone down after our Series-A closing. Therefore XLO had to reimburse him. I refused to comply with Alex’s demands and said: I wish I could re-negotiate my Agilent Stocks that I had purchased at $140/stock. The Agilent stocks had gone down to $32 by then. Alex also wanted me to issue fresh stocks and load him and myself up!!! I became frustrated with Alex’s demands. In one such incident, @PejmamNozad was a witness because he was working at the carpet shop next door. I took Pejman Nozad (whom I was trying to help out) and @RahimAmidi to Alex’s office, that was located on the 3rd floor of a building next door to the carpet shop, to be a witness to Alex’s outrageous demands. But Alex changed characters right in front of my eyes. He changed gears to his innocent character and with some soft voice, he basically said that he had NOT said so. I was baffled by his blatant lie. Little I knew then that @RahimAmidi would sell me out to Alex, and would be stabbing me in the back, sometime later during the 1st coup. Amidi sold me out to Alex when Alex promised him some stocks from the Option Pool if events at XLO served Alex’s ambitions. @PejmanNozad whom I was trying to help out, would be stabbing me in the back too during Alex’s 2nd coup.

The picture above shows a man sitting on a chair with knives hitting on his back. The major back stabbers with the biggest knives were by @RahimAmidi @SaeedAmidi, @PejmanNozad and @WilsonSonsini.

The caption on the above picture says: “You can’t blame me for my trust issue”.

@WilsonSonsini Support for the VC:

Alex seemed to have enjoyed from the endorsement and support of #WSGR who said: The transfer of stocks from the Option Pool to Series A investor (with no more money invested) was a “Business Matter” not a “Legal Matter”. So WSGR supported the VCs at the expense of diluting ALL Common Share holders. @WSGR gave me THE WRONG advice. I refused to take WSGR advice. I disgustedly said: If a Black guy stole a sandwich from a 711 store, the system would throw him into prison. But Alex wanted me to legally steal stocks away from my co founders with impunity?!

I argued back: If the market valuation had increased, would Alex on behalf of the investors, and WSGR, have agreed to giving the Option Pool to the founders? I referred to the market valuations that we had fixed six months before and said: A deal is a deal is a deal and ALL the parties had to accept, honor and abide by all of the terms, not just some of the terms of the deal, or renegotiate stocks valuations after the stocks were purchased at the closing of Series-A.

Alex wanted me to become his accomplice. So he doubled down on his demand and said: “Let’s split the Option Pool 50/50 between us (between Alex and myself, implying that I would become his accomplice)”, because he said: “Your co-founders never had the money to sue us or to take us to the court! And that WSGR would pave the way for ALL transactions between us”. Following that meeting, I immediately shared Alex’s comments with Mr. Nader, my co-founder, VP and fellow Board member. Nader in his always thoughtful and soft tone said: “Alex thinks the Option Pool was (part of) his entitlement”. Nader and I agreed not to let Alexander F Hern or @Amidzad (Amidis) draw a wedge between us.

Alex was not focused either: One day he wanted me to generate revenue for XLO, the next day he wanted me to file for more patents so that he could sell XLO within a year. He used to comb his hair in so many opposite directions and put hair lotions on them. I once told him that XLO was not like his hair that he could direct in opposite directions and put some lotion on it to make it look good.

Then the VC and WSGR plotted a scheme to bring me down as CEO and took over the company. They celebrated after my down fall as CEO because they then could issue stocks and re-load themselves (the preferred share holders and whomever they chose from the common share holders) with impunity. With only $9 MM of VC investment in XLOptics, we were 10 horse lengths ahead of InPhi and 13 patents ahead of a company that later became Infinera.

Alex’s excuse to topple me down as CEO came after XLO’s June BOD meeting. I will explain it next.

However; Let me make a long story short, Alex, Amidi and his puppet CEO bankrupted/destroyed the company by greed and mismanagement. Then they claimed: The company did NOT have a good product and should NOT have been funded at all!!!! Looking back, I had made a major mistake by trusting @WilsonSonsini (#WSGR) as the company attorney. WSGR was anything but fair to XLO, and to founders. WSGR was in bed with the VCs.

Part 3:

The underlying niche market for XLOptics was optical components that would clean up the aberrations of the communication long haul and metro networks, and deliver pure and clean signals as the Communication (Comm) market went to 40 Gig and 100 Gig speeds. The XLO main theme was to clean up the signal optically, before the detectors, rather than cleaning them up electronically after the detector. However, The Communication sector was collapsing right in front of my eyes in the summer of 2001. I was NO longer receiving phone calls from #VCs begging me to raise money from their funds.

The market was falling apart, nose diving south, right at the rate of 2% to 5% a week. So I invited the most important and key people in the company to the Board of Directors (BOD) meeting on a Friday afternoon in June. XLO’s company premises was across the street from Applied Material’s headquarters. XLO had 5 BOD Members. Mr. Nader and myself. Alex F Hern (@AlexHern) and Chris Russel from SVIC. We had not yet agreed upon the 5th BOD member. Peter Burckhardt of SVIC and SVIC lawyer always attended the BOD meetings too. For over an 1 1/2 hour, I laid down a vision for confronting with the collapsing market by describing and considering the market challenges over the next three years. I said that we had to re invent XLOptics by moving from a component company towards a system level company, because the market was ripe and required new innovations. With Cisco and Juniper already in the market, there was a need for a new Optical Network player. I said that I was confident that we could raise a ton of money for such a company. So I said that I was assigning the entire option pool (about 40% of the total stocks) to Behzad Razavi + his team + Ali Hajimiri, then would either buy out or work in synergy with Dr. Bardia Pezeshki (Behzad’s Stanford roommate) of Santur, Dr. Behzad Moslehi of IFOS, and (several others) in software ….I explained my vision for XLO and said that we could put a system together and become the customer of our own components. I also said that this strategy will position XLO to raise huge amounts of money because VCs would be interested in investing in a system level company. {This niche market became the target market of Infinera (that had some other name then) founders who raised $85 MM almost a year later from Applied Materials}. I was in full control of XLO and knew how to navigate XLO during, and had no fear of, the upcoming recession. Not only I did not fear, but also enjoyed, the upcoming recession because the recession would separate the men from the boys. I felt it was challenging, just like playing soccer when my team was down by three goals. I knew I could score and win the game for my team. During the June board meeting, I also said that I could meet the payroll of the existing team by offering turn around services and create a minimum of 10% return for our investors. I also said that there could be a remote possibility that I might have to impose across the board pay cuts to all employees of XLO including myself, but I would guarantee a 10% return for the VC during the up coming recession. I knew this would have worked because I had implemented it in my other businesses (my glass business) during the previous recession. I also argued that the best companies came out of the recessions such as @Oracle, @Microsoft, ….

Near the end of the meeting Mr. Shobeiri, XLO’s CFO, presented the July budget to the Board that unanimously resolved and approved XLO’s July budget. The budget had called for the purchase of certain equipment. For some reason Alex did not attend that board meeting. But SVICs other board member as well as Peter and SVIC’s lawyer, and XLO’s key VPs and CFO/COO were present.

The following week, XLO’s CFO and one of the VPs sent out a check for the purchase of the equipment. Silicon Valley Bank reported the transaction to SVIC!!! (how come?)

After the 4th of July weekend, one night the furious Alex and his lawyer came to XLO. He asked me to either fire the guys who sent out the check, or he would fire me!!!

{Side Note: Before I explain the rest of the story, I should mention that in those days, I used to play soccer with president and CTO of At&T at Stanford twice a week. He was my teammate and a great goal scorer.I knew how to pass the ball to him and put him in a scoring position. AT&T ws the largest customer of Cisco routers. My XLOptics products would fit in Cisco routers. I repeatedly told Rahim Amidi, and Alex Hern that I was a teammate of AT&T CTO. I needed $10 MM to finish up design and manufacture of a limited sample products, then I could have AT&T spec and certify XLOptics products, then I could sell a ton of those to Cisco and take the company public within 4 to 5 years. But Alex kept saying that he wanted a fast exit and wanted to sell the company to Intel or National Semiconductor, or …, some other player in the market}.

Alexander F Hern also said that 10% return on his investment was NOT interesting to him. He mentioned that his time was much more valuable and that he would close down the XLO rather than receiving 10% return on his investment. He said that he had a habit of making $600 MM in a year and that my offer of giving him 10% return on his investment during the recession was an INSULT to him. I said that he probably did not hear the entire BOD discussions and my vision for the company. I was going to incorporate more products into company portfolio and raise a ton of money. I also told him that the market dynamics had changed, thus XLO had to change gears and adapt to the new market realities. I also told him that it would take 7 to 10 years for a company like XLO to go public so the notion of making $600 MM in one year was just a dream.

{A side note: History proved that Alex’s other company #ArcSight went public 8 years later!!! The CEO of @ArcSight, a retired Marine, once met me on University Avenue in Palo Alto, many years later after XLO, and apologized to me about what Alex had done to XLO. His apology meant a lot to me}.

Alex was just furious over my guys who had sent a check out. As I was trying to calm him down, I told him that my guys did not buy a Mercedes for themselves with company money. They purchased an equipment for the company according to an annual comprehensive budget plan that XLO produced and VC approved 5 months earlier. Second, The Board of Directors approved the July budget specifically in the June BOD meeting. So I said I did not understand what the fuss was all about? He said XLO was such a disgrace to him and that he did not want to be associated with it. I offered him some chocolate! He said he would fire me if I didn’t fire XLO’s VP and XLO’s CFO.

About two weeks after the June BOD meeting, @WilsonSonsini (#WSGR. @WSGR) produced the minutes of the June BOD meeting. @WilsonSonsini was supposed to produce the minutes within 48 hours after the BOD meeting terminated. It took @WSGR more than two weeks to produce the minutes. In the minutes, there was NO mention of my vision for the company (1 1/2 hour of my talk) that I had offered and laid down to the Board, discussing the people whom I was going to bring on board, for over an hour and half during the June BOD meeting. I should have asked a court reporter to write down the BOD discussion for $150/hour rather than paying $700/hour to WSGR for either an incompetent, or VC biased, recording of the BOD discussions.

Moreover, WSGR position about the approval of XLO’s July budget was dubious. @WilsonSonsini said that the company officers of XLO had to wait for the subsequent BOD meeting to RATIFY the resolutions of June BOD meeting!!! So in a sense, WSGR was saying that XLO officers had to wait for the next board meeting and should NOT have sent the check out after the June BOD meeting. I jokingly replied that if we had to halt the operations of XLO up until July BOD meeting to ratify the June BOD resolutions, then we had to wait and halt operations of XLO up until Aug BOD meeting to ratify the ratification of June BOD meeting and then we had to halt the operation of XLO up until Sept BOD meeting to ratify the ratification of the ratification of June BOD resolutions… and pretty soon… the corporate decision making in the US corporate world would tumble down with indecisiveness… and that the WSGR position on the board matter was absurd to say the least. @WSGR proved one more time that @WilsonSonsini attorneys were in bed with the #VC: @AlexanderHern of @SVIC.

In the subsequent meetings with Alex, since he had missed the June BOD meeting, I drew some boxes on the white board and tried to convince him about my all Optical System level proposal. I told him that I could raise $50 to $100 MM for the optical system. He was not getting it. It probably was way over his head. Peter did not get it either, or may be pretended that he was not getting it. Or may be they both got the idea, but were scared of the $50 MM to $100 MM investment. There too was an economic reason for Alex preventing me from realizing my vision. Let me explain: @AlexHern used to manage a $130 MM fund @SVIC. My proposal of driving XLO into a system level company, was way too expensive for him and his small fund. He wanted to finance ALL of the future rounds of XLO by his fund and did not like to entertain the possibility of bringing other VCs into the game, at least not until Round D. In one word, he wanted to be the only @VC of XLO and build up the stock majority in the future rounds assuming full control of the company before bringing in other @VCs into @XLO.

So naturally, and finally (making a long story short), Alex agreed with me signing up Behzad Razavi’s Transpectrum Technology. Because I had set aside the Option Pool for Behzad and his team plus Hajimiri. I needed a $10 MM investment to get things off the ground. So Alex agreed with part of my vision (signing up Behzad Razavi), and discarded the rest (creating an all Optical System that required $50 MM to $100 MM to get it off the ground).

While Alex was draining me from all my connections’ information and business ideas, he also planned for my removal as CEO because: 1) I had not fired my CFO and VP who sent out the check for the equipment, 2) I did not assign the Option Pool to him and resisted his temptations of splitting the Option Pool between him and myself with @WilsonSonsini as the facilitator of the transaction. 3) After my co-founders had filed for patents and had assigned the ownership of the patents to XLO, Alex had asked me to fire some of my weak co founders and place their un-vested stocks in the Option Pool for the benefit of Alex and his culprits whom he called his friends.

Alex loved and worshiped every stock of XLOptics.

So in all of the 3 fronts as described above, I had resisted his temptations. Meanwhile Alex loved and admired me for my business know how, connections and most importantly for my vision. He once said: “The only problem with Dr. Imani (me) was that Imani was not ready to be a player in his (unethical) game plan for XLO”.

Meanwhile, sometime in late June, Amidi had come up with his own CEO designate, a product line manger from Broadcom, who was supposed to bring 7 to 8 accounts from Broadcom plus 70% to 80% market share and $10 Million of investment money to XLO. Amidi’s motivation was to bring someone who would give Rahim and @SaeedAmidi extra stocks for facilitating the transaction. @WilsonSonsini loved transactions, because, they could bill the company at astronomical rates.

So with the approval of #WSGR and @RahimAmidi, Alex planned for the 1st coup against me. That story comes next. But before I explain Alex’s 1st coup, I have to say the following:

I knew a storm was coming. So I gathered all my troops (about 10 Ph.Ds and 10 Engineers for a total of 20 people), and narrated the following story to them. I told them:

During the summer days in, when I was 5 or 6 years old boy, we used to play in the alleys of Southern Tehran with my friends. A stream of water used to flow in the middle of our alley. Everyone of us had a couple of plastic toy soldiers. We used to set up imaginary battle fields and played a fictitious war game among ourselves. There was Amir Abbas too, the 12 may be 13 year old son of a decorated army colonel, who had many many many many toy soldiers, battery powered tanks, battery powered airplanes with sirens, with light coming on and off and … He used to be twice as larger, as taller, and as heavier as each and every one of us. A bully, he could and did beat us up very well.

When Amir Abbas brought his boxes of toys and began to play with us, every one of the 5 year old boys, including myself, were mesmerized. But as soon as we set things up to play, he used to collect his toys, put them back in his boxes, and then would go to the 5 year old kids of the down stream alley, and would do the same thing with them.

I was 5 years old, much lighter and much smaller than Amir Abbas, then. One day, I gathered all the little kids, from the up stream alley, middle stream alley and down stream alley, and told everyone we should not let that mischievous 12 year old upset us. All 15 to 20 kids agreed. I gathered them all in one place and started playing one day in the up stream alley and one day in the down stream alley. But when Amir Abbas came by, we completely ignored him. With his boxes of toys in his hands and in his toy cart, he had to stand out there watching us play. I ordered my friends, the little kids, not to even look at him.

After a while, he begged to play with us, and I let him play with us if he abandoned his abusive behavior and played with other kids in equal terms, under the same conditions. He agreed.

It was then, as a small tiny 5 year old boy, that I recognized I was a leader. I was born to be a leader and will die as a leader.

Tears came off the eyes of my co workers at XLO after I finished narrating the above story. I knew I had the support of everyone at XLO.

Part 4:

Before I explain the rest of the story, I should make this side note: Nader in disbelief humored that “Alex wanted the entire option pool without paying any money for it! Nader was right. Shortly after, Rahim Amidi who had heard of Alex’s intention through Pejman Nozad Spy, confronted me at a casual meeting at his carpet shop. Rahim Amidi said that he was entitled to 5% of the total stocks of the company (out of the option pool) becuase he had helped putting the deal together. I was just astonished. Later that day, when I went back to XLOptics I noticed a few of my co-founders were asking for some extra stocks from the option pool. So “Asking for extra stocks” had gone viral inside and outside of XLOptics. Everybody wanted a bigger piece of the pie from the option pool. I resisted Alex Hern, Rahim Amidi, and a few of my co-founders, who all solicited extra stocks from the option pool for themselves. I resisted everybody. So one of my disgruntled guys said: “Dr. Imani was a Nobody, We made him who he is (meaning CEO)”. A few days later I heard from Rahim Amidi: “Dr. Imani was a Nobody”. Yet a few days later I heard Alex Hern repeat exactly the same words: “Dr. Imani was a Nobody, we made him CEO”. i laughed it up and let it go unanswered.

Another side issue came up. One of my designers told me that he had found a problem with the original design. I asked him to prepare the simulations for me. A day or two later, he came back with simu

Alex had decided to fire me as CEO because I refused to take up on his indecent proposal of assigning the entire Option Pool (I had set aside about 40% of XLO’s stocks for Professor Ali Hajimiri, Professor Behzad Razavi and team) to him, and refused to fire XLO officers who sent a check out for the purchase of an equipment after XLO Board of Director had approved XLO’s July budget in the June BOD meeting. So let me put it more precisely: Alex wanted to fire me because I didn’t even assign 50% of the option pool to him, so he used the outcome of the June board meeting as an EXCUSE to fire me. I blame Wilson Sonsini for not recording the BOD minutes comprehensively. Jeff Saper first wrote the minutes of the June BOD meeting but then DID NOT DEFEND his own recording of the minutes. Meanwhile Alex did not have the votes in BOD, nor the quantity of stocks to vote me out by voting his stocks. So Alex used his objections to the minutes of June BOD meeting, compiled and distributed by @WilsonSonsini, to fire me. After the June BOD meeting, and in the middle of July, Amidi & Alexander F Hern told me they wanted to check up on the company. So I invited them in and served them lunch. But then they started talking and talked for about 8 hours addressing my employees, co-founders and common share holders who had gathered to hear them. Alex recounted his accomplishments of selling his last company for $600 MM within a year, and that he could turn around any company he focused on (He was non-sensing because history proved he could not make $600 MM every year or every other year, or in the last 15 years), and said to everyone that:

He said that he was an expert in turning the companies around and selling them within a year. Then with a sympathetic voice he said: “Why are you guys working so hard when Dr. Imani (me) has most of the stocks of the company?”. Meanwhile Amidi said to me in front of everybody: “Dr. Imani you are sacrificing the future of the company along with the interest of the preferred share holders for your own ambitions by remaining as CEO. We have a much more qualified person (a product line manager from Broadcom!) than yourself to run the company”. I reiterated my previous positions that there were eligible people inside XLO among my VPs (Mr. Nader), and or from outside of XLO, I considered Ahmad Bahai (CTO of National Semiconductor, and later Texas Instrument) and Kambiz Hooshmand (VP of StrataCom that was sold to Cisco, Cisco was to be one of XLO customer) as proper people to replace me {I had never talked to either one of these two guys about the XLO’s CEO position, I just threw their names because I knew even if I could bring Jesus Christ from heavens as my candidate for CEO, Alex would have rejected him}. But Alex dismissed them by saying: ” Would either one of your CEO designates bring 80% market share, 7 or more accounts from Broadcom, and $10 Million of investment as soon as we sign him up? He implied in front of everyone that his CEO designate would bring all of the above to XLO (including a $10 MM investment) while I could not guarantee any of the above either by myself or by either one of my CEO designates. History proved that Amidi and Alex’s promise turned out empty, hollow, and just a big lie. I replied by saying that let’s bring your guy as VP of marketing, if he delivered on ALL of the above promises, then I would resign as CEO. But Alex replied by saying that his CEO designate (a product line manager from Broadcom) was a CEO quality character and that Alex would not disgrace him by offering him a job lower than CEO.

I thought of myself as the glue that bonded everyone together (see the picture above), so I started defending myself and my reputation as a qualified CEO. I said that I was on the top of my game, I had a great vision for the company, I knew most of my customers, and I was playing soccer with president of AT&T who could open a lot of doors for me because AT&T was the customer of my customers (Cisco and Juniper). But Amidi said: “You are agitating your co workers against the Investors”!

I should have kicked both of them out but instead, I put myself and my leadership up for a vote by ALL employees of XLO. Except for one person who mildly supported me or I should say didn’t supported me, ALL my other employees and co-founders stood by me, approved me, and endorsed me as the proper CEO for the company. As Amidi was leaving XLO after 8 hours of torturing me in front of all my employees , Amidi said to Alex: “I am tired of this shit … you need to get your money back from this company”.

To this date, I regret NOT throwing both of these clowns, Alexander F Hern and Amidi, out of the premises of XLOptics that day.

I told my team that I needed to be nice to Alex and Amidi or they would not give proper recommendations to the Series B and future would be investors of XLOptics (Alex had stated so). Saeed Amidi ‘s Brother picked up on my comment and later engaged in deformation of my character after XLO, and stopped me from getting involved in other startups or raising money for my own.

I knew then and in retrospect, Alex and Amidi were NOT looking for a CEO quality person like me. They were looking for an accomplice who would legally assign the rather large option pool to them, and in the future, issue more fresh stocks and load up Alex, Amidi and those who were friends with them.

During those torturous 8 hours, I reached out to WSGR (@WilsonSonsini Goodrich and Rosati) and asked for help. @WilsonSonsini responded by saying that the investors had the “Rights” to check up on company status. It was another wrong advice by @WilsonSonsini. No they DID NOT have the right to engineer a coup against the CEO for 8 hours. @WilsonSonsini did not throw a rescue rope for me, and implicitly approved the coup by dismissing my objections.

I had won the battle but lost the war after that day. Let me explain: After that day, I lost control over my employees who thought I owed my job to them! The progress of XLO went down to a snail crawling speed from running like a Jack Rabbit prior to the coup. My troops became sloppy in turning over their progress reports and missed milestones. Moreover, almost everyone started asking for more stocks from the option pool (about 40% of XLO’s stock) that I had set aside for Ali Hajimiri, Behzad Razavi, and his team. Several days later, I had to call a meeting and discuss, for 10 hours, how we came up with distributing the stocks at the Series A closing. It was just another torturous day for me. I could not drive me troops like I used to before the coup. It became obvious to me as I monitored their progress. But I thought that time would heal the wounds.

(Note: this is part of the story about XLOptics, a very successful startup company that Amidi and Alexander F Hern took over, bankrupted the company through mis-management, and then blamed me, Behzad Imani @bimani, for everything that went wrong with the company. They stained my reputation beyond repair. Saeed Amidi (now at @PlugAndPlayTC), Rahim Amidi (@Amidzad) and Pejman Nozad (now at PearVC) went on an blocked my fund raising efforts in my subsequent startups by propagating false rumors). @RahimAmidi was a mentor to, and was/is partner of Saeed Amidi (now of Plug And Play Tech Center), Pejman Nozad (now of @PearVC).

Part 5:

Before I tell the rest of the story, let me set and define the characters involved:

@PejmanNozad used to work at Amidi’s carpet store next to SVIC offices. Pejman character reminded me of the combined character of John the Bartender, “who lit up my smoke”, and the Waitress, “who played politics” all for some tips in the Billy Joel’s 1973 hit music video “The Piano Man”. The new money, uneducated and always hustling Alex Hern was his role model then.

@RahimAmidi was this Hippie looking character who tried to imitate Al Pacino’s Michael Corleone character in Godfather Mafia movie. He wanted “no one take side against family” with one exception: He defined himself as the entire family. So he used the good name of his family and his late father to shield himself.

@AlexanderHern was trying to imitate his favorite movie character Al Pacino’s Tony Montana in 1983 top hit movie Scarface, with two exceptions: Having been raised in a divorced family with a terrible childhood, “The Scar” was on Alex’s soul not on his face. Moreover, he mistook the streets of Silicon Valley for those of Little Havana.

@SaeedAmidi was the mildest one of this bunch for, unlike the others, had a 4 year college degree.

Jeff Saper was a character that I liked very much until I saw him in bed with Alex, politically speaking, trying to cover the tracks of Alex by any means possible.

Now here is the rest of the story:

After the failed coup attempt by AlexanderHern and @RahimAmidi on behalf of @SaeedAmidi and @PejmanNozad, I instructed my team NOT to talk to the VCs. I was surprised by the participation of Amidis in the failed coup attempt against me. Especially because I was holding their hands and was introducing them to startup business and because they, as @Amidzad, had only invested $150,000 in @XLOptics.

@AlexanderHern always knew what was going on inside XLO. I didn’t know then but much later I learned that @PejmanNozad on behalf of Rahim and @SaeedAmidi, had inserted a “Spy” within XLOptics who reported the inner workings and status of XLO to Amidi and Alex through @PejmanNozad. The Spy was a cousin of @PejmanNozad whom I had been trying to help out a lot. Pejman acted like a hot shot but was very poor, and used to work at Amidi’s carpet store next door to Alex’s SVIC office. I had the heart of Jesus Christ for the poor because I was born and raised in Southern Tehran. I came from a special culture where we would share our lunch box with the poor and needy at the expense of remaining hungry ourselves. Southern Tehran is where the real men come from, and where the characters of real men and women are defined.

@PejmanNozad asked me to hire his cousin. So I did, because I wanted to help him and his family out. But actually, his cousin turned out to be a Spy for the investors and for SVIC. He used to report the sentiment of the team and progress of XLO, or there lack of, to Amidis and Alex through @PejamnNozad.

After the 1st coup, and after I had to assemble the team together and discussed how and why everyone received his stocks, Alex had learned that Dr. Imani had become a weak CEO through @PejmanNozad Spy.

@AlexHern and Amidi were relentless. After the first coup they had smelled blood. They wanted to take over XLO. So Rahim and @SaeedAmidi and @AlexanderHern went on engineering a 2nd coup. But before explaining the 2nd coup, I need to discuss my LA trip in the last full week of July.

After the failed coup attempt by @AlexHern and Rahim and @SaeedAmidi, I told my troops that I intended to sign up Hajimiri and Razavi (+ team). However, less than 4 hours (or say 1/2 day) after I told my troops that I had planned for a trip to Los Angeles to get the ball rolling on signing up professors Ali Hajimiri and Behzad Razavi, my cell phone mysteriously (!) rang. It was Peter who then put Alex on the phone. Alex invited himself to the trip, or I should say he imposed himself on me to take him to LA with me (How did he know I was going to LA? Answer: I did not know then but now I know it was through @PejmanNozad SPY). I first refused to accept but later I thought that the failed coup attempt was very humiliating experience for Alex and Amidis because I thought they understood the meaning of humiliation. (I was wrong, they never knew what humiliation meant because they were uneducated new-money characters). With my heart of Jesus Christ, I forgave Alex for the failed coup attempt against me.

So I invited Alex to go with me to LA for two reasons:

1) Per my fiduciary responsibility, I used to, had to, report my companies strategic moves to my Board of Directors (BOD). I had discussed my intentions of allocating the entire option pool (about 40% of XLO’s stocks) to Professor Behzad Razavi and his team plus Professor Ali Hajimiri. I also had invited Ali Hajimiri from CalTech to Palo Alto offices of SVIC where he met with Alex F Hern. I was completely open with my VCs. However Alex and Amidi were NOT open to me at all. Alexander F Hern constantly planned and plotted against me and my baby (@XLOptics). Alex’s ultimate goal was to attain TOTAL CONTROL over XLO.

2) I needed Alex’s positive recommendation of XLO to new VCs, as I wanted to bring another VC to XLO to force Alex to assume a normal behavior. Alex had threatened me that unless and until I conformed to his demands (by firing my officers and by assigning him the Option Pool), he would NOT make proper and positive recommendations about XLOptics to other VCs whom I was getting ready to talk to. His behavior was very binary and irrational. He didn’t mind destroying XLO if he didn’t get his terms from XLO deal.

Alex didn’t want another VC to participate at XLO as an investor and invest in XLOptics. He wanted to a) assume the option pool, b) dilute my co-founders by offering freshly issued stocks to Behzad Razavi, and Hajimiri and then c) Alex would invest another $10 MM into the company himself and dilute everyone even further. Alex was thinking that with these moves, he could become the absolute majority owner of XLO’s stocks and then could do whatever he wanted with @XLO without fearing any legal resistance. In the process he wanted me to become his accomplice. I refused to take up on his offers. So he designed a 2nd coup. In short he wanted to gobble up XLO with or without me at the helm as CEO.

As described above, and toward the end of July and per my fiduciary responsibility, Alex invited himself to my LA trip, to @CalTech and @UCLA, to meet up with Professors Ali Hajimiri and Behzad Razavi, on a Wednesday and Thursday of the last week of July, respectively. Alex asked me to take him with me. I said OK for political reasons. I agreed. But then he brought with him an entourage of lawyer and business development guys.

During our meetings in LA, both professors Hajimiri and Razavi told me that they had been visited earlier by someone else on Tuesday and Wednesday (one day prior to our meetings) in that week? I asked them who had paid them a visit? I learned that Alex had instructed Amidi’s CEO designate to pay a visit to the two professors one day in advance of our visits to LA. Alex’s action was clearly against his fiduciary responsibility toward XLO for the following reason: He should have kept the BOD discussions and XLO’s strategic plans confidential per his fiduciary responsibilities toward XLO. But Alex never cared about any fiduciary responsibilities of #XLOptics.

When at Behzad Razavi’s office, I told Behzad that he should be careful dealing with @XLOptics. I told him that if XLOptics’ attorney or even if I offered him a 4 year vesting in an offer letter, he had to refuse it and that he had to ask for up front full vesting. The reason was obvious: Just as Alex wanted to fire XLO co-workers after they had assigned the patents to XLO and produce the first samples, Alex wanted to fire Behzad Razavi after he submitted and assigned his circuit designs and samples to XLO before the end of his first full year of vesting. So Behzad would have ended up with 1/4 of the pledged stocks of XLO to Behzad. Alex worshiped each and every stocks of XLO.

Alex was relentless in his pursuit of taking over XLO. On Thursday, we had lunch at the Beverly Hills Hotel where he remained cocky and did not take my objections to him seriously after he had released company plans to an outsider (Amidis’ CEO designate). Alex thought and threatened me that he could bypass me and XLOptics by investing $10 MM directly on Behzad Razavi! And then would impose Amidi’s CEO on Behzad Razavi. I told him that it would be against his fiduciary duties to XLO. Alex’s lawyer agreed.

He also insulted Mr. Shobeiri, our CFO, and slandered him as a loyal dog to Behzad Imani (me). Suddenly, the hands of God played a role. The table shook. The drinks spilled over his pants and made him wet. He looked liked he had peed in public. The guests at the hotel were stirring and laughing at him. He had made a fool of himself.

Despite Alex’s predatory behavior I kept my composure and did not get angry at all. After visiting the professors Ali Hajimiri and Behzad Razavi, I convinced Alex that my strategy would work and that I would accept the deal flow as: I would assign the Option Pool (the 40% stocks of XLO) to Hajimiri, Razavi and his team, and then @AlexanderHern would invest $10 MM for 10% to 20% additional fresh preferred stocks that BOD of XLO would issue and assign to @SVIC. Everyone would be diluted equally across the board. I was very mild mannered and always catered to @AlexanderHern ‘s ego. For my notes, I called this deal as the “The LA Deal”. Alex agreed and I felt my mission was accomplished. I was very happy that finally Alex acted reasonably and responsibly.

On Friday moring, I took a 9 a.m. Southwest flight out of Burbank airport to San Jose, where as usual the flight was delayed by almost 4 hours. We were sitting like sardines inside the 737 on tarmac at a scorching 120 degree heat. By mid afternoon I was back to XLOptics in Santa Clara. I suffered from heat exhaustion when I saw an open letter email by one of my disgruntled co-founders. He had CCed everyone at XLO who had witnessed me becoming a wounded CEO after the first coup attempt by @AlexanderHern and Amidi. Under ordinary circumstances, I could deal with whining employees as easy as my taking a stroll in a park. I ignored the email on that Friday afternoon and said that I would deal with it on Monday morning. I was exhausted by the LA trip and the negotiations resulting in LA Deal. Up until then, “we the common shareholders” had one lawyer representing all of us. After seeing that email, I decided to withdraw myself from the pack in the upcoming weeks, and from being represented by the same lawyer who represented my co-workers. I asked myself, how I could be represented by the same lawyer who represented another person hostile to me.

This is when @PejmanNozad Spy stabbed me in my back and compromised me. He had reported the open letter email by the whining worker to Alex. Moreover, he had said that the attitude of people inside XLO was NOT in favor of Dr. Imani. That was why Alex decided to forget about our LA Deal and exert pressure on me again. So he engineered a 2nd coup.

The next Monday, I attended a meeting with Alex at 9 a.m. at @WilsonSonsini with Jeff Saper. While paying $700/hour to WSGR, Alex was late as usual again by 2 hours. I thought we were going to finalize the mechanism for his new $10 MM investment. I took my lawyer with me as a shield from Alex because he had breached his fiduciary responsibilities toward XLO by his awkward manners, the 1st coup, and by instructing an outsider to visit XLO targets in LA.

At Jeff Saper’s conference room, Alex was a shivering like a cold mouse. He was shivering when he saw my lawyer. I took my lawyer with me to the meeting as a sign that I was going to be hostile to Alex if he continued with his irrational demands and tricks. But Jeff Saper calmed Alex down by telling Alex that he didn’t need to worry about my lawyer because my lawyer (who had worked for @WilsonSonsini in the past) was “OKAY”. I re-iterated what I had said during the June BOD meeting and what the specifics of “The LA deal” was…… Then I said I could position the company for growth during the recession by going into subsystems and systems level products (similar to what became Infinera) and raise a ton of money. Also, I could sell both XLO products (Optics components combined with CMOS circuits) and could give 10% to 20% returns to investors for their investments until the recession would end in 3 years. Jeff confirmed and agreed with my vision. I told Alex that he should not feel any imposition. If he didn’t want to invest in XLO, he didn’t have to. I just wanted Alex to give proper recommendations about XLO to the future VCs. I knew Alex didn’t want to see any outside VCs in XLO.

Alex referred to some documents that I had signed after he accused me of having an extra marital affair with a VC lady. I said that whatever I signed on “was NOT part of the Series-A docs”, and so they were invalid (not valid). Jeff Saper told me to hold on to all my moves, and wait for three days, and until he could see all of the evidence, and until we could put everything we agreed upon (about Alex’s Series-B investment, “the LA Deal”) in an official BOD minutes. Alex agreed without enthusiasm. But his agreement lasted for 10 minutes and up until the time we left the meeting. Alex wanted total control over XLO. He did NOT want any outside VCs coming in. I knew it.

Alex quickly designed a 2nd coup against me. I always admired him for thinking up on his feet, so quickly and so fast. He should have worked for military or CIA on some covert operations. He could access the situation, re evaluate his options, and improvise his strategy within minutes. He decided to challenge me by engineering a 2nd coup right there and then.

If there ever was a Ph.D. in Charlatanism, I would give it to @AlexanderHern, @PejmanNozad and @RahimAmidi.

Part 6:

I never suspected @PejmanNozad, who lit up my smoke, of being such a backstabber. For 5% of XLO’s stocks, Pejman/Amidis had convinced Alex that their CEO candidate would steal away market share/accounts from @Broadcom for XLO. After my LA trip, & referencing an open letter by a disgruntled co-worker to me, Pejman/SPY had alerted Alex that Imani had become a weak CEO. So Alex caught up with me at @WilsonSonsini parking lot and said he would honor the LA-Deal if and only if I hired Amidi’s guy as CEO. Otherwise, Alex would not let outside VCs come into XLO, And would drive XLO to bankruptcy (by withholding XLO’s Budget confirmation), and would go public about my affair (what affair?!) with a VC lady. Alex left me with the impression that he had lined up some of XLO’s key people with himself (He had). I went back to XLO but didn’t know whom I could trust except for Shobeiri/Nader. Meanwhile, @PejmanNozad SPY informed my troops that Imani had cut out a side deal with Alex!!! Creating “Lack of Trust”, was how Alex’s 2nd coup against me kicked off. Alex succeeded. Then Alex fired everyone including Prof. Razavi (after signing him up and transferred his technology) and put their unvested stocks in the Option Pool. But by doing so, Alex / Amidis destroyed XLO.

Here are the details of the events:

After we left the meeting with Jeff Saper at @WilsonSonsini, Alex (@AlexanderHern) caught up with me in the parking lot. He said that he would NOT give proper recommendations to the future VCs about me and or XLO, would stop VCs from investing in XLO, and would withhold the XLO budget (He’d take approval of XLO’s Budget as Hostage) until XLO would go out of business unless I hired Rahim and @SaeedAmidi ‘s CEO designate. Alex said that he was ready to write off $9MM, but, “Are you ready to write off XLO?” he asked me. He knew how dear XLO was to me. He also said that he would go public with my affairs (what affairs?!) with a VC lady, and with the papers that I had signed after Series-A funding, when he accused me of having an extramarital affair with a VC lady (a fake allegation, so CNN was not the first inventor of Fake Allegations, Alex Hern was, and before CNN and Alex, Evil was the master inventor of Fake Allegations), would use them against XLO and myself, and would prompt and support the already disgruntled employees of XLO to take legal action against me. He gave me the impression that he had lined up some of my employees and my co-founders against me. Alex had previously said that he would either split my unvested stocks and the option pool with my co-founders or give my stocks to my co-founders and bypass me completely. He stressed: He would honor our LA deal only if I accepted Amidi’s CEO designate as CEO of XLO. I said I would take that under advisement! Alex was convinced that Amidi’s CEO candidate would steal away market shares and accounts from Broadcom and bring them over to XLO. (I hated my employees in my other business when they left and took away my accounts and market share with themselves to my competition so I didn’t approve of Amidi and Alex Hern’s strategy. I thought I could grow XLO organically and honestly). Amidi’s (#Amidzad) were to get 5% of XLO stocks for introducing their CEO to XLO.

Alex obviously knew about the Friday open letter email by some disgruntled employee to me. @PejmanNozad/his Spy had alerted Alex that Imani had turned into a weak, bleeding CEO such that his own troops would challenge him and would write him open letters.

Never, not even one in a million I suspected @PejmanNozad who was quick with a joke and lit up my smoke would be such a deplorable Backstabber. But then, many years later, I thought and told myself: “you cannot blame yourself for your trust issue”. I was trying to help this kid, and in return, he stabbed me in the back. Well, he wanted to get ahead at any cost.

Please note: I never met Alex again up until that fateful night of the 2nd coup some eleven days later on a Thursday night. (He only called me once, 10 days later, and told me that my co-founders were sucking up to him. I explain his call to me later).

So on Monday around noon, I returned to XLOptics after the meeting at #WSGR, and after Alex caught up with me at the Parking lot, and after stopping by a coffee house. During my drive back to XLO, I called my lawyer and told him that Alex completely re nagged on his promises at @JeffSaper (@WSGR) meeting. My lawyer advised me not to talk to anyone until we examine Alex’s claims. I was ready to sue @AlexanderHern, @SVIC, @WilsonSonsini and anyone of my troops for compromising XLO’s progress any further from then on. Deep down, I felt that I was the best CEO with a great vision, with know-how of the market, and the Glue that sort of bonded everyone and everything together. I needed everyone to trust me. I could not accept any mutiny any further.

On Monday shortly after noon, I was at XLO but had a mixed feelings: Except for Mr. Shobeiri and Nader, I couldn’t trust my troops because I was concerned about Alex’s mold inside XLO (I didn’t know then who the mold was or who the molds were). Everyone at #XLO had gathered at XLO kitchen area to see what I had been up to since my LA trip. I had been away for almost a week. I looked at everyone’s face and without referring to last Friday’s email and without telling what had gone on in Los Angeles or at #WSGR meeting, and without referring to my last conversation with Alex at the @WilsonSonsini parking lot, I said: “This is Silicon Valley, I have to be prudent and take care of my own interest. It is upon the advice of my lawyer that I cannot trust everyone here. I have to have my own lawyer, separating myself from the common shareholders”. Later I also emphasized to my troops that I could only trust either Mr. Nader, and or Mr. Shobeiri or both. If everyone of my co workers agreed, I would tell everything in detail to one of these two or both of these two gentlemen but not to everybody, until I would become clear about what was going on, where we legally stood, and what was going to happen between Alex, Amidis, Wilson Sonsini, XLO and myself. My fear was that one or more of my troops had been corrupted by Alex after Amidis and Alex’s first coup. I was right. I didn’t know who the SPY was but many years later I learned the SPY was @PejmanNozad’s.

My other fear was that I might have had to sue XLOptics (my baby) if Alex circumvented me and gave away my un-vested stocks to my co-founders. I also thought of suing @AlexanderHern and SVIC if they didn’t give proper recommendation to an outside (a 2nd or 3rd) VC for Series-B investment, or if they circumvented XLO and directly invested in Behzad Razavi’s Transpectrum Technologies. I was also thinking of suing @WilsonSonsini for being in bed with Alex. My mind was clogged up examining my options depending on the upcoming scenarios. Here is how the 2nd coup continued:

By the afternoon, Pejman Nozad Spy (@PejmanNozad now of @PearVC), had told my co-founders that I had struck a side deal with Alex. Suddenly I saw people, my own troops, turning away from me, avoiding me. My own employees went on a strike against me and silenced me. I thought they were kidding me at first! I didn’t know which deal they were talking about. Were they talking about my “LA Deal” with Alex at the end of our LA trip when Alex finally had accepted my terms and conditions for allocating XLO’s entire Option Pool to Behzad Razavi + team, Ali Hajimiri? And Alex had accepted to invest additional $10 MM into XLOptics? The LA Deal was a great deal for XLO. What deal they were talking about?!

But by Tuesday afternoon, I learned that these guys were pretty adamant. They refused talking to me. They silenced me completely. (To this date, I don’t understand why they silenced me, because I had offered to tell everything to Shobeiri and Nader but not to all of them). By Wed afternoon, My lawyer called and said that Alex did not have a case against either XLO or me stemming from those papers that I had signed after he accused me of having an extramarital affair with a VC lady. I knew he didn’t have a case because it was a Fake Allegation to begin with.

On Thursday morning, I gathered everyone in the conference room, and told them that my options had become somewhat clear. I was ready to take action against Alex if needed. I needed the support of my co workers. I received none. However, @PejmanNozad Spy had demonized me in front of my co-founders, co workers, and employees based on some erroneous and #Fake information that he had provided: “Imani had struck a secret side deal with Alex!”. The History proved otherwise. The history proved him WRONG and a Liar. @PejmanNozad proved to be a backstabber and a Charlatan.

I was silenced by everyone of my co-workers, as if I was not the CEO anymore. I could have easily played my dirty card by firing those co-founders and employees who exercised mutiny, and then could have given their un-vested stocks to Alex, who worshiped each and every stock of XLO. But that was not me. Because It was against my Southern Tehrani Shia culture, and because I had the heart of Jesus Christ even for my enemies. I could never fire those guys who were, inadvertently, digging their own graves by placing their trust on Alex.

About 10 days later from the start of Alex’s 2nd coup (Alex’s 2nd coup started in the parking lot of @wilsonSonsini), on a Wednesday, Alex called me. He said that my co-founders were sucking up to him. He said they were desperate about meeting with him. He called me a “fool” for having supported my co-founders and protected the stocks of my co-founders ever so much. I didn’t trust a word Alex was saying after seeing him how he had behaved in the past. Alex was a Liar, and a BiPolar. So I came out of my office, looked around XLO offices, didn’t see any of my key guys around except for Mr. Falahati and my secretary. I asked where were my troops? My secretary didn’t know. So I called my lawyer and upon the advice of my lawyer, I wrote a letter to an adjunct professor at @Stanford confirming what he had told me about Amidi’s CEO …. I was trying to protect myself in case Alex succeeded in the 2nd coup.

Still nobody talked to me. XLOptics had become non-functional. Zero, Nothing, No progress. It was as if everyone had taken a vacation without my permission. People showed up to work, and worked, but without direction, with no enthusiasm.